What is Inflation?

Inflation is a key economic concept referring to the rate at which the general level of prices for goods and services is rising, and subsequently, the purchasing power of currency is falling. It is a phenomenon that impacts every aspect of the economy, from consumer spending to government policies.

Measuring Inflation

Inflation is typically measured by the Consumer Price Index (CPI) or the Producer Price Index (PPI). The CPI tracks the changes in prices from the consumer’s perspective, while the PPI measures changes from the producer’s point of view. These indices help in understanding how much more expensive a set of goods and/or services has become over a specific period, often a year.

Causes of Inflation

There are several causes of inflation, broadly categorized into demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply. Cost-push inflation happens when the cost of production increases, leading to an increase in prices. Built-in inflation is related to the expectation of future inflation, driving up wages and, subsequently, prices.

Effects of Inflation

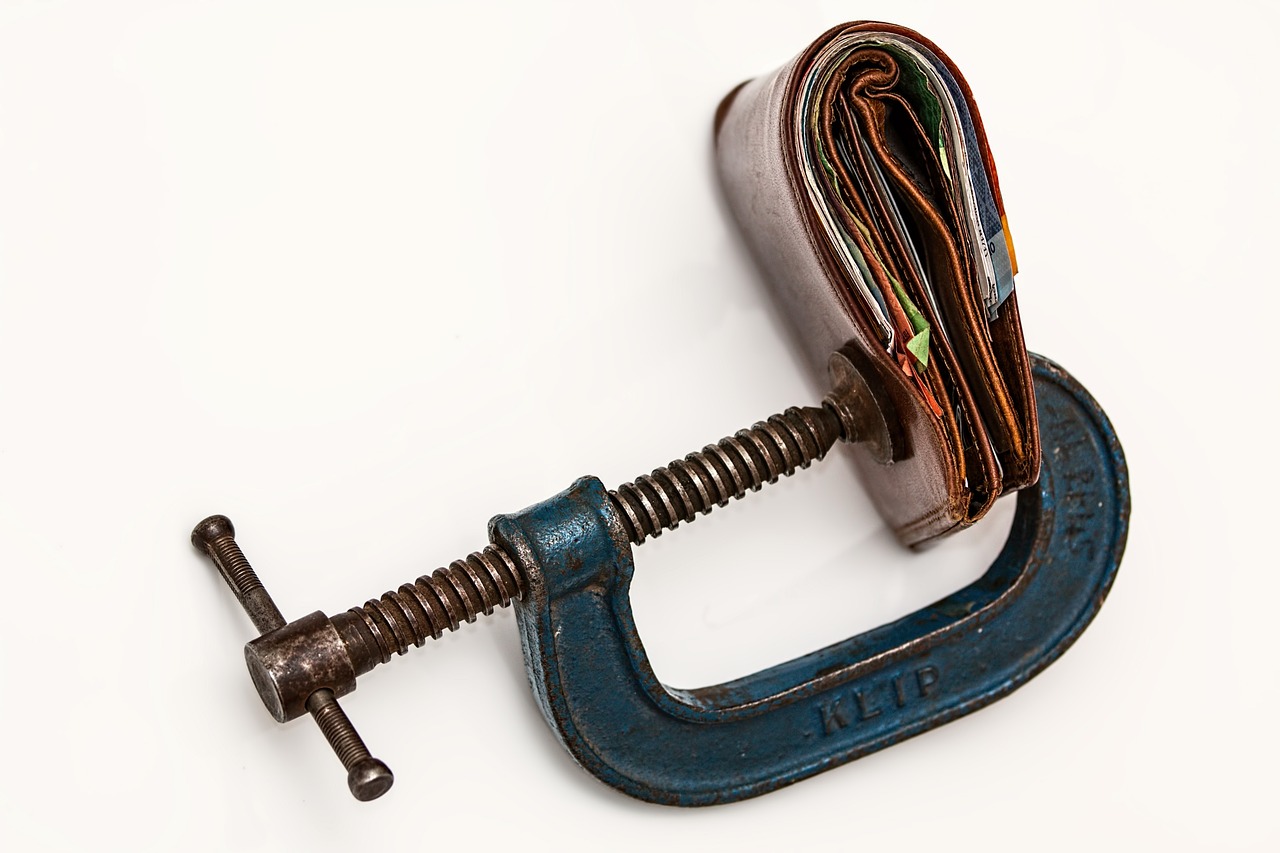

Inflation’s effects are widespread, influencing individual purchasing power, investment decisions, and economic policies. A moderate level of inflation is often indicative of a growing economy, but high levels of inflation can lead to economic instability. For individuals, inflation means that the same amount of money will buy fewer goods and services over time.

Managing Inflation

Central banks and governments use various tools to manage and control inflation. Monetary policies, such as adjusting interest rates, are commonly used to control inflation. By raising rates, central banks can cool down an overheating economy, and by lowering them, they can stimulate spending in a sluggish economy.

Inflation’s Impact on Personal Finance

Understanding inflation is crucial for personal financial planning. Inflation can erode the value of savings and affect investment returns. Individuals need to consider inflation in their budgeting, saving, and investing strategies to ensure their financial stability over time.